Have you found yourself envisioning the prospect of laying down roots in the lively city of Sydney? The present moment offers a golden opportunity to turn that daydream into a tangible reality. In this extensive exploration, we will intricately navigate the multifaceted Sydney real estate landscape, providing detailed insights into the nuances of timing your purchase, effective budgeting, and seizing opportunities that can pave the way for a seamless journey into homeownership. Thinking if it’s a good time to buy a house? Uncover the hidden gems within Sydney’s diverse neighborhoods, learn the art of strategic planning for market fluctuations, and discover time-sensitive government programs that may open doors you never thought possible. Is it a good time to buy property in Sydney? This is your roadmap to making Sydney your home sweet home.

Sydney Real Estate Landscape

Sydney’s real estate market is a vibrant and dynamic realm, boasting an array of neighborhoods and diverse property types. From the energetic city center to the tranquil suburbs, there exists a niche tailored to every taste and lifestyle. As a first-time homebuyer, unraveling market trends and grasping local nuances is of utmost importance. Dedicate ample time to explore different locales, attend open houses, and vividly imagine your life in the diverse neighborhoods Sydney has to offer.

- Discovering Local Character: Immerse yourself in the pulse of Sydney’s cultural hubs, discovering the local flavors, artistic expressions, and community events that contribute to the city’s dynamic spirit.

- Weaving Dreams into the Fabric: Consider this exploration not merely as a quest for property but as a journey to find the perfect backdrop for your life’s story. Each suburb holds its narrative, waiting to intertwine with yours.

- Navigating Market Dynamics: Recognise the evolving patterns of the real estate market. Keep your finger on the pulse of shifts, understanding how they can impact property values and the overall buying experience.

- Historical Perspective: Explore past trends for valuable insights into the cyclical nature of Sydney’s real estate market. Historical context empowers you to make well-informed decisions as you embark on the exciting journey of first-time homeownership.

Sydney’s real estate is not just about finding a house; it’s about sculpting a home. An understanding of market dynamics coupled with historical context provides a nuanced approach, allowing you to navigate the ever-changing landscape with confidence and foresight. So, step beyond the threshold of a mere home search; embrace the immersive experience of curating your lifestyle in Sydney’s diverse and dynamic neighborhoods.

Considerations for Timing Your Purchase

Embarking on the path to homeownership in Sydney necessitates a thorough understanding of critical considerations. Before diving into the real estate market, it is imperative to assess your budget and financial readiness, bolstering your position through mortgage pre-approval. Strategic planning becomes indispensable in navigating the fluctuating dynamics of buyer’s and seller’s markets. Wondering if it’s a good time to buy a house? Assess your readiness and explore the potential in Sydney’s real estate market. Is it a good time to buy property in Sydney? These are pivotal questions that require careful consideration. So here are some things to consider:

Budgeting and Financial Readiness With the Market

Before immersing yourself in the market, cultivate a thorough understanding of your budget and financial readiness. Bolster your negotiating position by obtaining pre-approval for a mortgage. Given the fiercely competitive nature of Sydney’s real estate scene, having your finances in impeccable order provides a distinct advantage. Scrutinise your monthly budget to determine a comfortable mortgage payment, and explore potential additional costs like property taxes and homeowners association fees.

- Seek pre-approval for a mortgage to enhance negotiation leverage.

- Evaluate monthly budget to determine a comfortable mortgage payment.

- Explore potential additional costs such as property taxes and association fees.

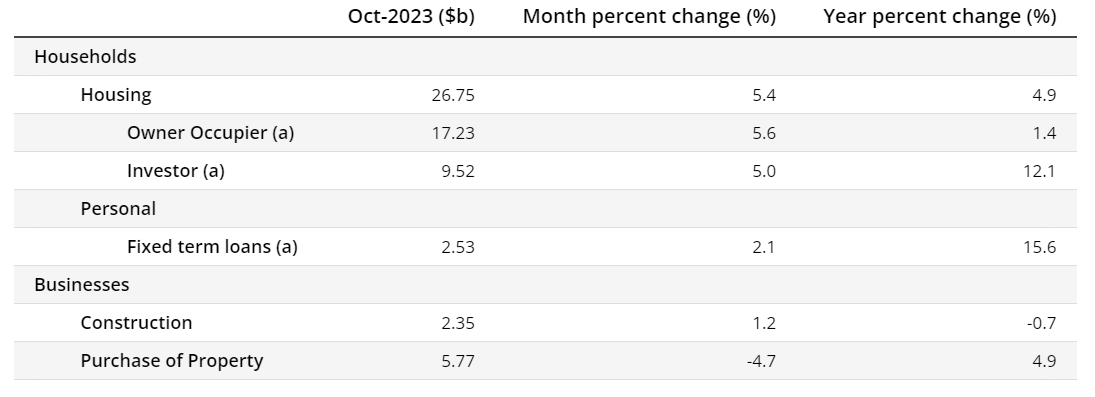

Additionally, keep an eye on the sum of newly accepted loans by borrowers, adjusted for seasonal variations. ABS has stated the amount borrowed for fixed-term personal finance, reflecting loans with set repayment periods, witnessed a 2.1% increase, following a 3.0% rise in September. Meanwhile, the amount borrowed for purchasing road vehicles saw a 1.5% uptick, and personal investment loans experienced a notable 3.7% increase. These insights suggest a growing trend of individuals seeking loans for personal investments during this period.

The sum of newly accepted loans by borrowers, adjusted for seasonal variations

Strategic Planning for Navigating Market Fluctuations

Real estate markets are characterised by ebbs and flows, necessitating preparedness for both buyer and seller’s markets. Develop a strategic plan that adapts to market changes. In a buyer’s market, negotiating power may be enhanced, while a seller’s market demands swift decision-making. A flexible strategy becomes your ally in navigating the ever-shifting real estate landscape in Sydney.

Time-sensitive Government Programs

You are most definitely wondering “Is it a good time to buy a house when you’re not too familiar with any special programs?” To give you a short answer – staying informed about these programs will increase your chance in buying your dream house. So stay vigilant about government programs tailored to support first-time homebuyers. Some programs extend grants, subsidies, or tax incentives that can significantly alleviate the financial burden. Be proactive in capitalising on these opportunities as they arise, making homeownership more accessible for first-time buyers.

- Regularly check for government programs offering grants, subsidies, or tax incentives.

- Act promptly to take advantage of financial support opportunities.

These steps will help you on your way to purchasing a house you actually want.

Tips for Timely Decision-Making

As a house first time buyer that’s in the hustle of Sydney’s real estate market, making quick decisions is crucial. You might be wondering is now a bad time to buy a house and should first time buyers wait to find out when to buy first house with the best rates possible. Well to answer these questions you should probably team up with a real estate agent who understands your likes and can act fast on your behalf. Respond swiftly to new listings, and be ready to make an offer when you find the perfect home. These people will help you pay attention to these elements:

Staying Informed

Knowledge remains the linchpin in the real estate game. Stay abreast of market trends, interest rates, and local developments. Regularly peruse property listings, attend open houses, and engage with real estate professionals. The more informed you are, the better positioned you’ll be to make prudent decisions throughout the homebuying journey.

- Stay updated on market trends, interest rate changes, and local happenings.

- Regularly check property listings and attend open houses.

- Engage with real estate professionals for insights and advice.

In the realm of real estate, maintaining a comprehensive awareness is paramount. Consistently monitor property listings and participate in open houses to grasp current market conditions. Stay abreast of trends, interest rates, and local developments for a nuanced understanding of the landscape. Actively seek insights from real estate professionals, leveraging their expertise to make well-informed decisions throughout the homebuying journey.

Recognising Indicators

Sharpen your ability to identify key indicators that may sway the market. Economic trends, job growth, and infrastructure developments wield influence over property values. By staying tuned to these indicators, you can make judicious decisions aligned with the long-term prospects of your investment.

- Keep an eye on economic trends, job growth, and infrastructure developments.

- Stay attuned to indicators influencing property values.

In the dynamic real estate environment, proficiency in recognising key indicators is imperative. Monitor economic trends, job growth, and infrastructure developments closely, as these elements exert substantial influence on property values. Maintaining vigilance over these indicators equips you with the foresight needed to make judicious decisions aligned with the enduring prospects of your investment.

Capitalising on Potential Property Value Appreciation

Purchasing a home not only represents a significant financial commitment but also a prudent long-term investment. To maximise this investment, explore areas that show promise for property value appreciation. Consider neighborhoods undergoing revitalisation or those slated for infrastructure enhancements, as these factors often correlate with increased property values over time. Some things you should do for a smooth transition:

- Conduct thorough research on neighborhoods exhibiting potential for growth.

- Investigate ongoing or planned infrastructure developments.

- Explore local economic indicators and job market trends.

A strategic property purchase in a burgeoning area can contribute substantially to the appreciation of its value over time. This foresight allows you to align your investment with the evolving dynamics of the real estate market, potentially reaping significant financial benefits in the future. As you embark on this journey, weigh the long-term potential of your chosen location and position yourself to benefit from the upward trajectory of property values.

Final Thoughts

So is it a good time to buy a house nowadays? Well, commencing the odyssey of first-time homeownership in Sydney represents a captivating undertaking laden with prospects and some minor challenges. But the vibrant real estate journey of the city offers a unique chance to turn daydreams into reality. This exploration delves into multifaceted aspects of Sydney’s property landscape, guiding you through timing considerations, effective budgeting, and seizing opportunities for seamless homeownership. Uncover neighborhood gems, master strategic planning, discover government programs, and capitalise on potential property value appreciation. This serves as your guide to make Sydney your forever home.

FAQ

1. What is the cheapest month of the year to buy a house?

The most budget-friendly months for purchasing a house can vary, but generally, studies indicate that January and February are opportune times due to potential seller motivation and reduced buyer competition. It’s crucial to consider that regional factors and economic conditions can influence pricing dynamics.

2. What is the most expensive time to buy a house?

Conversely, the priciest period to buy a house typically falls within the spring and summer months, spanning from April to August. During this timeframe, heightened demand and favorable weather conditions contribute to increased prices, fostering a competitive market.

3. Are house prices falling in Sydney?

To stay informed about the current trend in house prices in Sydney, it is advisable to consult recent real estate reports, local market analyses, or trusted property websites, as market conditions are subject to change. These sources provide up-to-date information, ensuring you have the latest insights to make informed decisions in the dynamic Sydney real estate landscape.

4. How much will houses cost in Sydney 2025?

The analysis indicated that, by 2025, the anticipated average house prices in Sydney and Melbourne were $1.53 million and $1.02 million, respectively. Brisbane’s median house price was projected to be approximately $814,000 in two years, while in Adelaide and Perth, it was expected to be around $768,000 and $678,000, respectively. But of course, these aren’t exact numbers and you should always do extra research for safety.