Embarking on the journey of purchasing your first home is an exciting endeavor but often comes with the challenge of saving for a deposit, especially for first home buyers. In Sydney’s dynamic real estate market, understanding the nuances of deposit requirements is crucial for aspiring homeowners, especially those navigating the complexities of the first home buyer deposit. This comprehensive guide will delve into the definition, legal aspects, key influencing factors, and market dynamics surrounding first home buyer deposit in Sydney. Additionally, we’ll provide valuable budgeting tips to help you achieve your homeownership dreams.

Definition and Purpose of a First Home Buyer Deposit

A first home buyer deposit is more than a monetary contribution; it’s a commitment that sets the foundation for your homeownership journey. As you venture into the property purchasing process, understanding the purpose and significance of this initial payment is key. This deposit serves as a tangible demonstration of your commitment to securing your dream home.

Some helpful tips:

- Consider this deposit not just as a financial requirement but as a crucial step in turning your dream of homeownership into a reality.

- Research the specific deposit requirements for different property types to tailor your approach.

Whether you’re a first-time home buyer or looking to upgrade, comprehending the nuances of the first home buyer deposit is essential for a successful and informed home buying experience in 2023.

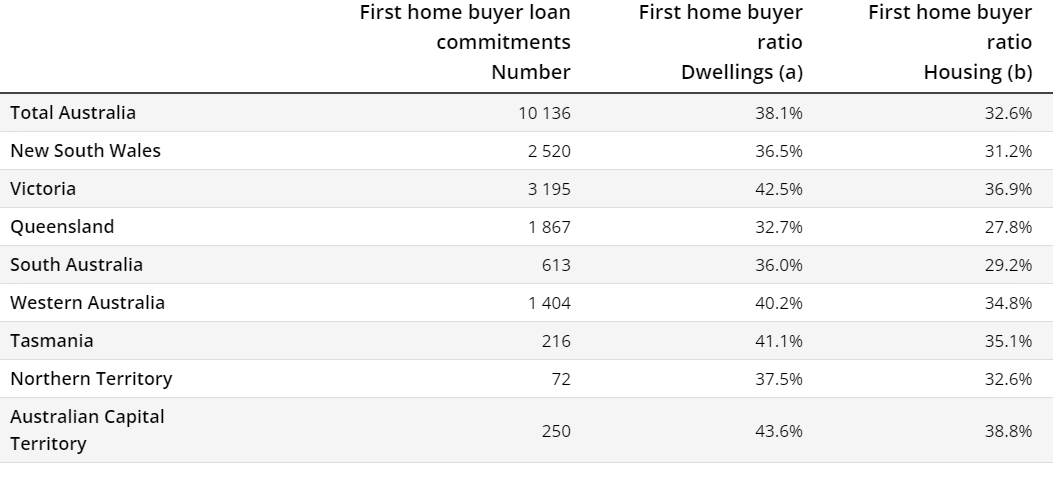

Speaking of this year, according to ABS in October 2023, more people across Australia decided to buy their first homes. Nationally, the number of new home loan commitments went up by 5.1% to 9,781, which is 6.8% higher than a year ago.

Legal and Procedural Aspects in Sydney

Sydney’s real estate landscape, akin to other cities, demands a nuanced understanding of legalities for a first home buyer deposit. It’s imperative to navigate the local regulations effectively, encompassing contract conditions and deposit release clauses. This knowledge not only safeguards your interests but also establishes the groundwork for a seamless and legally sound transaction. Here, we delve into the legal intricacies integral to the first home buyer deposit process, offering you a comprehensive guide to ensure you traverse Sydney’s real estate journey with confidence.

Tips for you:

- Attend local property law workshops or seminars for in-depth insights.

- Consult with a real estate attorney for personalised advice on Sydney’s legal requirements.

- Stay updated on any recent changes in property laws through reliable legal resources.

- Network with experienced homebuyers to gain practical perspectives on navigating legal nuances.

- Create a checklist of legal requirements and consult it at each stage of the home buying process.

Remember, staying well informed is your key to success.

Key Factors Influencing Deposit Requirements

Several factors, including market dynamics, deposit demands from sellers, and economic influences, play pivotal roles in determining the minimum deposit for first home buyers in Sydney. Understanding these factors empowers buyers to make informed decisions and navigate the market effectively.

Market Dynamics

Sydney’s real estate market, especially for first home buyers, is a dynamic arena influenced by various factors that directly impact the minimum deposit for first home buyers. Delve into these intricacies to navigate the market with finesse.

- Research Trends: Stay informed about current market trends, understanding how they affect property values and deposit expectations.

- Regional Analysis: Conduct a thorough analysis of different regions within Sydney, recognising variations in property demand and pricing dynamics.

- Property Development Impact: Explore how ongoing regional developments may influence the market, potentially altering deposit requirements.

Understanding the dynamic nature of Sydney’s real estate landscape empowers buyers to proactively adjust their strategies, making well-informed decisions in the face of market fluctuations.

Deposit Demands

Sellers’ expectations regarding deposit amounts are a crucial aspect of the home-buying process. Navigate this terrain effectively with the following insights:

- Clear Communication: Establish transparent communication with sellers to gain clarity on their expectations for deposit amounts.

- Negotiation Strategies: Develop effective negotiation strategies aligned with sellers’ demands while maintaining financial prudence.

- Legal Considerations: Be aware of any legal constraints or requirements associated with deposit demands to ensure a smooth negotiation process.

Having a comprehensive understanding of deposit demands enables buyers to anticipate and meet expectations, fostering streamlined negotiations and contributing to successful property acquisitions.

Economic Influences

Economic factors, including the minimum deposit for first home buyers, wield considerable influence over deposit requirements in Sydney’s real estate market. Delve into these broader influences to make informed decisions:

- Interest Rate Monitoring: Keep a vigilant eye on interest rates, as fluctuations can directly impact the affordability of homes and subsequent deposit requirements.

- Government Policies: Stay informed about governmental policies related to the housing market, as changes may affect deposit expectations.

- Affordability Dynamics: Understand how overall housing affordability trends in Sydney, including how much deposit for first home buyer is, may influence the financial aspects of home buying, including deposit requirements.

A comprehensive grasp of economic influences provides valuable context, aiding prospective buyers in making informed decisions and navigating the financial intricacies of the home-buying journey in Sydney.

Budgeting Tips for Saving the First Home Buyer Deposit

Saving for your first home buyer deposit is a significant financial goal that requires careful planning and disciplined budgeting. This section offers a comprehensive set of practical tips and guidance to help you maximise your savings potential, ensuring you are well-prepared for the exciting journey of homeownership:

Create a Dedicated Savings Plan:

Embark on your savings journey by establishing a clear and realistic savings goal for your deposit. Break down the overall target into manageable monthly or weekly targets, providing you with tangible milestones to track your progress. Consider automating transfers to your dedicated savings account to ensure consistency and avoid the temptation to divert funds elsewhere.

Explore Alternative Funding Sources:

Investigate government assistance programs or grants specifically designed for first-time homebuyers. Additionally, explore the possibility of family assistance or financial gifts that may contribute to your deposit. Some employers offer homeownership programs, providing another avenue to explore for potential financial support.

Cut Unnecessary Expenses:

Wondering how much deposit for first home buyer should be? Well, first conduct a thorough review of your monthly expenses to identify areas for potential cutbacks first. Assess your subscriptions and memberships, temporarily canceling non-essential ones. Opt for cost-effective alternatives in your daily spending habits, such as preparing meals at home instead of dining out.

Side Hustles and Additional Income:

Explore opportunities for side hustles or part-time work to supplement your primary income, considering the deposit required for first home buyers and how much deposit do first home buyers need. Monetise your skills or hobbies by offering services or products to generate additional funds. Allocate all extra income directly to your dedicated savings plan, accelerating your progress towards your deposit goal.

Prioritise High-Interest Debts:

Prioritise paying off high-interest debts to free up more funds for your savings. Consider debt consolidation strategies to streamline repayments and potentially reduce interest rates. Redirect the money saved from debt reduction towards your deposit, allowing you to build your savings more efficiently. This strategic approach not only accelerates your journey to homeownership but also positions you favorably for securing a mortgage with favorable terms.

Leverage Budgeting Apps:

Utilise budgeting apps to track your expenses in real-time. These apps often provide features that categorise and analyse your spending patterns, offering valuable insights. Set up alerts for overspending or when nearing budget limits to stay disciplined and within your financial goals. Embracing technology in financial management enhances your awareness and control, paving the way for a more robust and effective savings strategy.

Negotiate Regular Bills:

Contact service providers to negotiate lower rates on utilities or insurance. Explore competitive offers and be willing to switch providers if it leads to cost savings. Use the savings from successful bill negotiations to bolster your deposit fund, turning routine expenses into opportunities for increased savings.

Consider Renting Out Unused Space:

If feasible, consider renting out a spare room or unused space in your home. Explore short-term rental options or sharing arrangements to generate additional income. Ensure compliance with local regulations and safety standards while transforming your unused space into a revenue-generating asset.

Review and Adjust Budget Periodically:

Regularly review your budget to identify areas for improvement and adjustment. Celebrate milestones in your savings journey to stay motivated, recognising and rewarding your progress towards achieving your deposit goal.

By incorporating these detailed and practical tips into your financial strategy, you not only enhance your ability to save for a first home buyer deposit but also develop strong financial habits that will serve you well throughout your homeownership journey and help understand what deposit needed for first home buyer really is. The key is consistency, adaptability, and a proactive approach to managing your finances.

Final Thoughts

Your first home purchase is an exciting journey, but saving for a deposit in Sydney’s dynamic real estate market, including the deposit needed for first home buyer and first home buyer minimum deposit, can be challenging. This guide covered the definition, legal aspects, and market dynamics of first home buyer deposit, providing practical budgeting tips. Remember, your deposit signifies more than a financial commitment; it’s your pledge to securing your dream home. By researching specific deposit requirements and staying informed on legalities, you’re paving the way for a successful homeownership journey. Happy house hunting!

FAQ

1. What is the 2% deposit on a home loan in Australia?

The 2% deposit associated with a home loan in Australia denotes a payment equivalent to 2% of the property’s purchase price. Lenders mandate this percentage-based contribution when a borrower secures a home loan.

2. What is the minimum deposit for a first home buyer in Australia?

The minimum deposit for Australian first home buyers typically fluctuates, with many newcomers targeting a deposit ranging from 5% to 10%. The specific minimum deposit requirement is influenced by factors such as the property’s cost and the policies of the lending institution.

3. Can you buy a house in Australia with no deposit?

Although rare, acquiring a house in Australia without a deposit poses challenges. Lenders generally insist on a deposit to mitigate risks. Nonetheless, some borrowers explore alternatives like guarantor loans or government-backed schemes to reduce the initial deposit amount.

4. Can I buy a house in Australia as a foreigner?

Yes, foreigners can buy a house in Australia, but there are rules to follow. If you’re not a resident, you usually need approval from the Foreign Investment Review Board (FIRB) to purchase a home. Different rules might apply to temporary residents and non-residents, and getting FIRB approval is usually a necessary step before you can proceed with the purchase.