Reserve Bank of Australia (RBA) governor Michele Bullock has outlined why the RBA might be forced to make another increase to the cash rate.

The challenge, as she explained in a speech to the Australian Business Economists, is that inflation has entered a new phase, which will make it hard for the RBA to reduce inflation from 4.9% now to its target range of 2-3%.

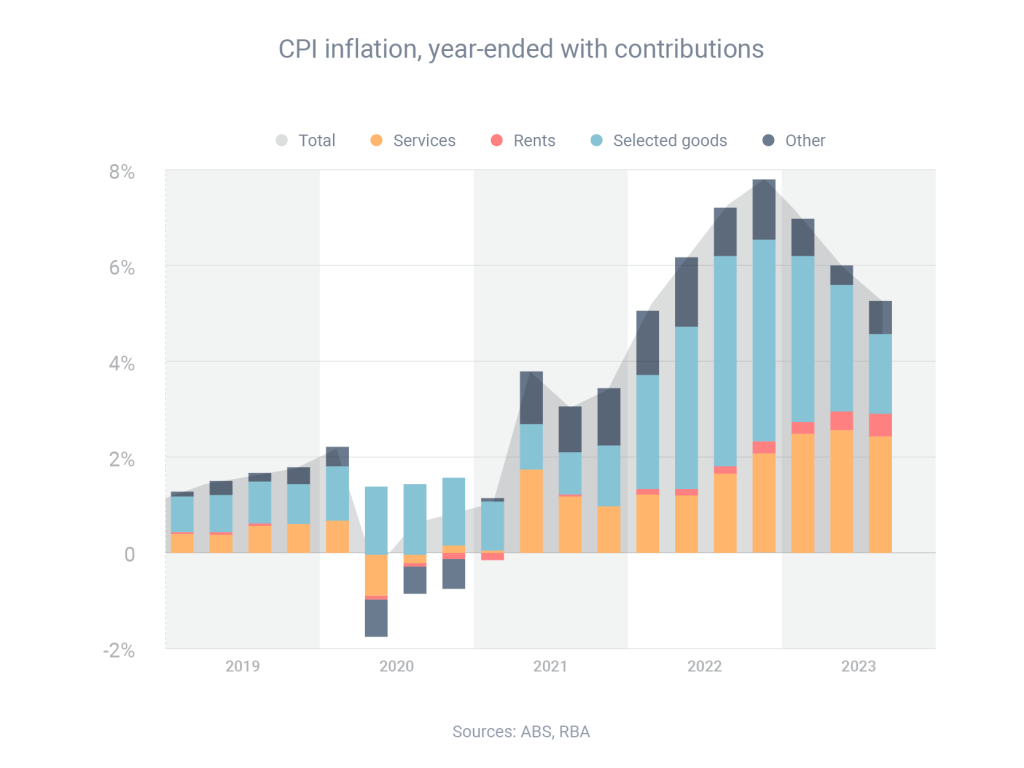

Governor Bullock said the initial surge of inflation, during which inflation rose from 2.1% in July 2021 to 8.4% in December 2022, was largely driven by international supply-chain disruptions. Now, though, the remaining inflation challenge “is increasingly homegrown and demand-driven”. We know that because:

- Inflation is broad-based

- Prices for services (such as hairdressers and dentists) are “rising strongly”

- Companies are struggling to keep up with customer demand

“This point is important because it has implications for the appropriate policy response,” Governor Bullock said.

If inflation was still being driven by international supply-chain disruptions, raising the cash rate would have little effect. “However, a more substantial monetary policy tightening is the right response to inflation that results from aggregate demand exceeding the economy’s potential to meet that demand,” she said.