How to Get The Best Home Equity Loan Rates?

Securing the best home equity loan rates can significantly impact your financial flexibility and the overall cost of your home

Securing the best home equity loan rates can significantly impact your financial flexibility and the overall cost of your home

Refinancing investment property can be a savvy financial move, especially in a changing economic climate. But when is the right

In the ever-changing landscape of Australia’s economy, knowing the intricacies of home loan refinancing can be a game-changer for you.

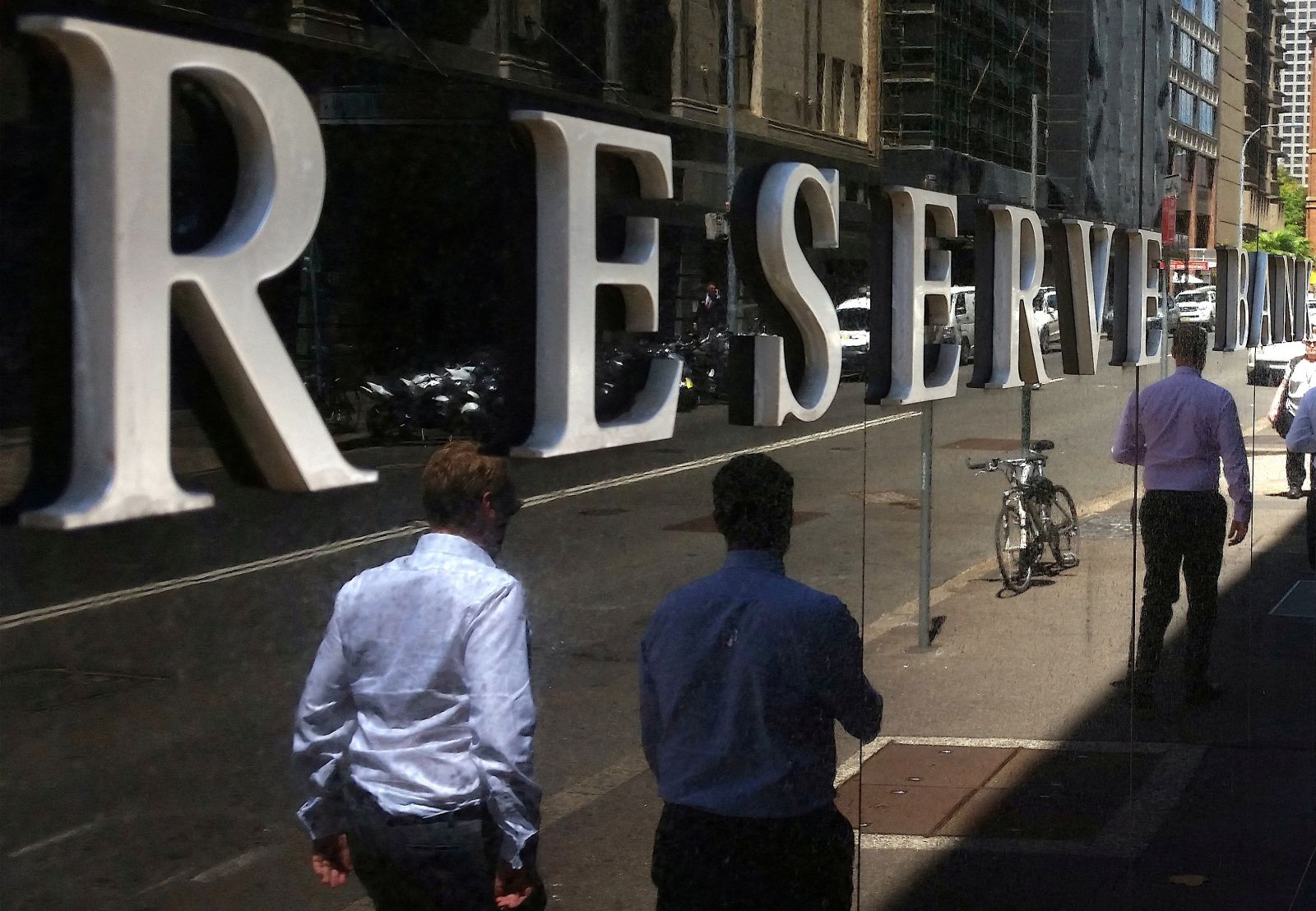

Many economists believe the Reserve Bank will start cutting interest rates in the final quarter of 2024. So if you’re

Despite the interest rate rises that have occurred since last year, rates are lower than one would expect due to

The Reserve Bank of Australia (RBA) has unveiled a series of reforms, in response to an independent review commissioned by

Financing can feel overwhelming whether you’re considering refinancing or buying your first, second, or even third home. Even for those

As the tide of low fixed interest rates begins to recede, Australian homeowners and investors who enjoyed these bargain rates

Are you prepared for the end of your enticing low fixed-interest rate mortgage? Like the ebbing tide, the era of

Australia’s mortgage market is experiencing a significant shift, with many homeowners coming off two-year and three-year fixed-rate loans onto much

© 2024 Unconditional Finance | All Rights Reserved.